By Etienne Mainimo Mengnjo

Experts say the world needs innovative finance to raise $200 billion annually to preserve biodiversity. This is one of the key lessons learned from the 7th Global Landscapes Forum (GLF) Investment Case Symposium, which ended last Friday, October 25, in Cali, Colombia.

During the 2024 UN Biodiversity Conference (COP16), experts and participants at the 7th GLF Investment Case Symposium debated and demonstrated how biodiversity finance can be effective, inclusive and sustainable – starting now.

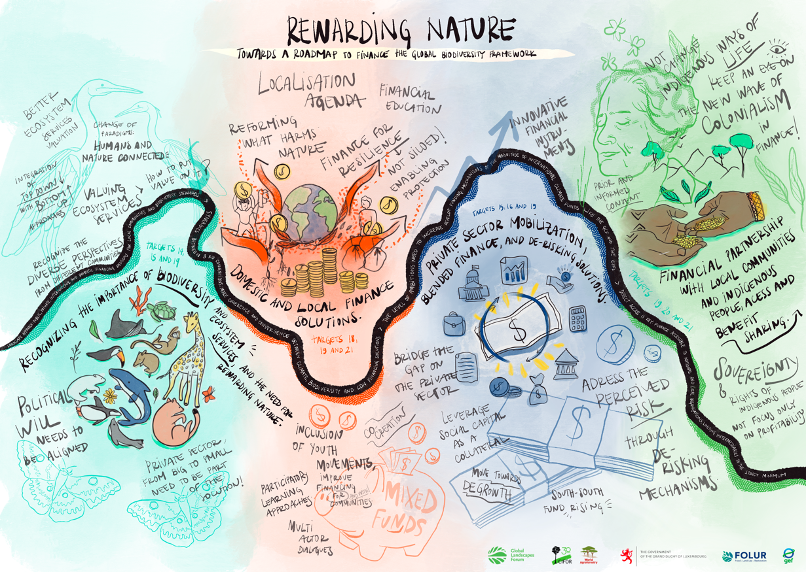

With over 600 participants attending in person and thousands more online, the 7th GLF Investment Case Symposium took place under the theme, “Rewarding Nature: A Roadmap to Finance the Biodiversity Plan.”

Even though the symposium sparked crucial conversations alongside the 2024 UN Biodiversity Conference (COP16) in Cali, the event emphasized the need to integrate biodiversity into financial systems and build synergies between the three Rio Conventions (CBD, UNFCCC, and UNCCD). The event was co-hosted with the Luxembourg–GLF Finance for Nature Platform.

Speaking during the symposium, Serge Wilmes, Minister of the Environment, Climate and Biodiversity & Minister for the Civil Service of Luxembourg, said the Luxembourg government has many ongoing initiatives between the private and public sector, where the co-benefits are essential.

“We have to find back the spirit of the 1992 Rio Earth Summit and work together on all levels. The Luxembourg government has many ongoing initiatives between the private and the public sector, where the co-benefits are essential: the economic, the social, and the ecological,” the Minister said.

“We need to strengthen the rights of local communities, Indigenous Peoples, women, and children globally,” added Serge Wilmes, Minister of the Environment, Climate and Biodiversity & Minister for the Civil Service of Luxembourg.

According to the Minister, the government’s goal is for projects to become significant and bankable, attracting investment, and then the money should be used by local communities because they know how to preserve and conserve nature and manage it sustainably.

“That’s why we work together with the GLF and develop initiatives such as Resilient Landscapes Luxembourg (RLL),” he said.

Experts and participants also explored the opportunities and challenges of artificial intelligence (AI) and new technologies, which hold enormous potential in unlocking new financial mechanisms.

“For AI to be innovative, we need to first clearly identify the problems we want to solve. Cross-sector partnership is essential to drive such innovation. For example, the private sector offers the capital and knowledge, academia adds the deep research and technical expertise, and local innovators bring regional context,” said Gabriela Gutierrez, Founder and CEO of Tabs AI.

Talking about Indigenous and local perspectives, experts underscored how informed consent, sovereignty, and shared benefits are essential to any financial innovation.

“Financing Indigenous Peoples is a global political commitment today, but we need to transform it into reality. Many Indigenous Peoples, organizations, movements, and local communities are conducting a debate process to create Indigenous-owned funding mechanisms,” said Kleber Karipuna, Executive Coordinator at The Articulation of Indigenous Peoples of Brazil (APIB).

Ane Alencar, Director of Science at IPAM, said, “Finance is a crucial catalyst element. We need to make sure that money is mobilized for conservation, biodiversity, and to support the cultures that safeguard biodiversity.”

He added, “Finance can also help develop new technologies, such as AI, allowing a better understanding of biodiversity, improving monitoring, tracing more effectively what’s happening with those engaging with biodiversity, and ultimately enabling the use of technology to truly conserve biodiversity without increasing inequalities.”

“To incentivize the private sector, we must address the perceived risk. Normally, private actors perceive biodiversity-related projects as high risk. We also need to address the uncertainty of the financial returns related to the early stages of biodiversity projects. Here is where blended finance plays a pivotal role by making biodiversity-related projects much more attractive and viable,” said Camila Silva Arango, Technical Assistance Manager at Finance in Motion.

Bambi Semroc, Senior Vice President at the Center for Sustainable Lands and Waters, Conservation International, said, “If we could get the top 70 companies worldwide in food, agriculture, retail, and consumer goods sectors to make nature commitments, we could see as much as 80 million hectares of land restored, better managed, and protected, alongside over a billion dollars in financing.”

During the event in Cali, the Amazon Environmental Research Institute (IPAM) joined the Global Landscapes Forum (GLF) as its 35th Charter Member. The GLF and IPAM will support local actors in leveraging the region’s unique biological and cultural diversity to tackle global challenges. The organizations announced their alliance at the 7th GLF Investment Case Symposium, held alongside the Biodiversity COP16, in Cali, Colombia.