By Etienne Mainimo Mengnjo

Hope turned to horror for countless Cameroonians recently after an online marketing platform, Multi-Digital Brandishing (MDB), which promised easy earnings for watching video ads, abruptly imploded, wiping out earnings of its thousands of subscribers.

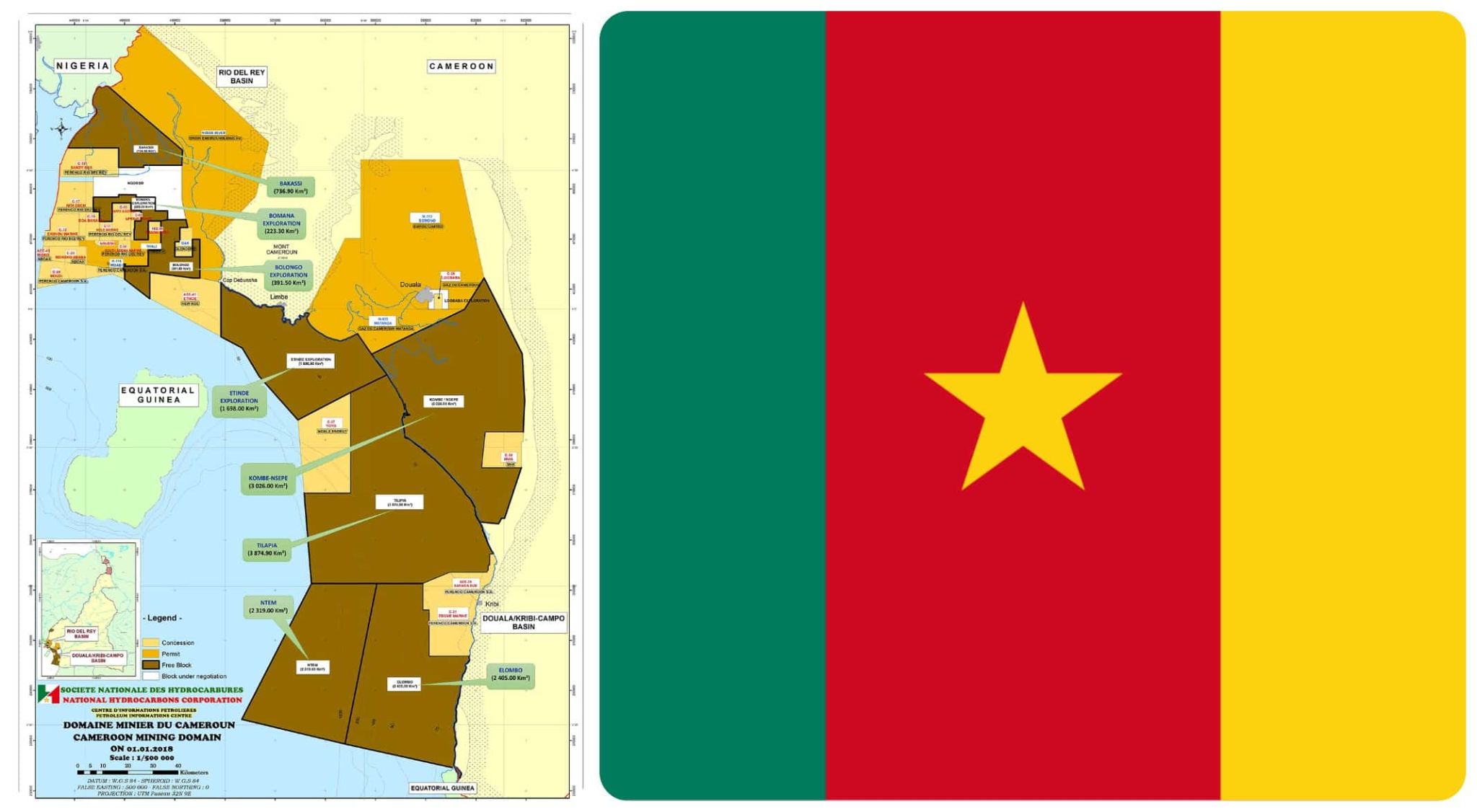

What was heralded as a lifeline out of economic hardship has now become a national scandal, leaving a trail of devastation and despair among its subscribers. The online marketing platform already had branches all over the country.

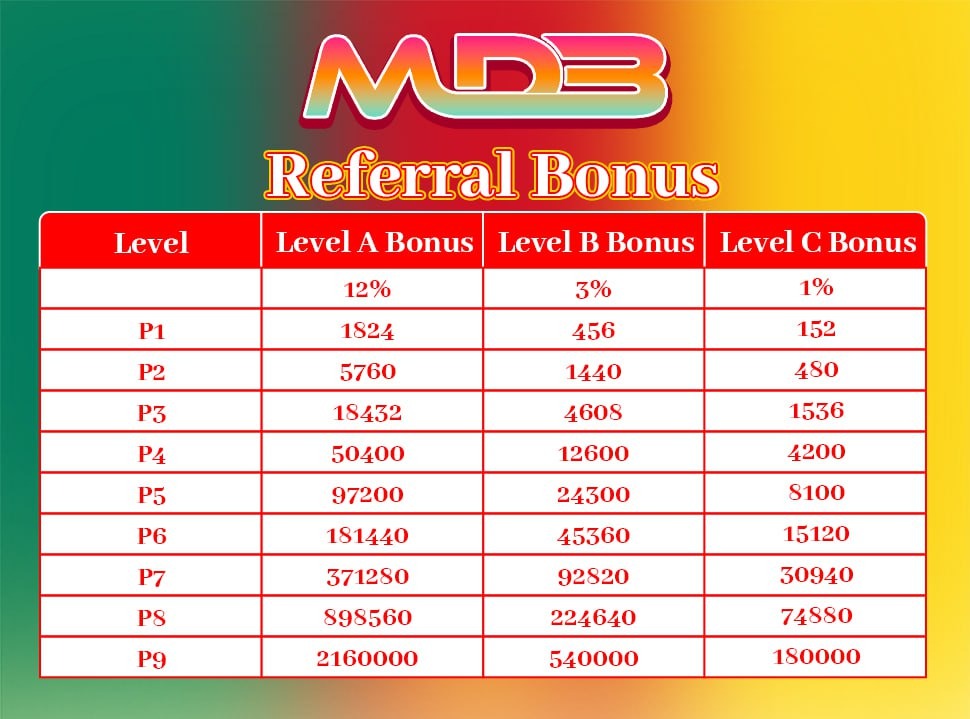

The MDB platform recruited users—referred to as “employees”—to invest at various tiers, with the guarantee of receiving daily profits ranging from FCFA 475 to FCFA 900,000 for every 15-second video ad watched daily.

“It felt like a genuine opportunity,” recounted one investor, who requested anonymity after losing hundreds of thousands of CFA francs. “The platform was running well, and we were making money. Everyone was calling it a savior from hardship.”

However, the anonymous investor stated that the first signs of trouble surfaced when MDB began declaring unscheduled holidays that halted all withdrawals. To the investor, the company initially blamed these stoppages on a claimed effort to integrate with financial institutions to “speed up payments.”

The excuses quickly escalated. After a three-day withdrawal freeze, the company announced a bombshell: The Cameroonian Ministry of Finance had allegedly rejected MDB’s documentation, declaring it not a legal entity.

The final, fatal move according to the subscribers was a desperate cash-grab disguised as re-identification. The company mandated an immediate re-verification of all accounts using national ID cards, a requirement many users could not meet. The platform then demanded a non-negotiable, tiered fee from every user to “activate” their account within a strict 24-hour window.

“They charged us a fee per level to activate the account and confirm identity,” a subscriber narrated. “If we didn’t pay, they threatened to block or freeze the account. This brought so much tension; many people simply didn’t have the money.”

When the deadline passed, the company briefly offered a six-hour extension before permanently locking the accounts.

“It was a final, cold-blooded maneuver,” another user told The Post. “Many people who rushed to pay the reactivation fee immediately found themselves blocked from the system.”

According to subscribers, the consequences of the collapse are staggering, moving beyond simple financial loss into a genuine humanitarian crisis. Subscribers who encouraged friends and family to join, or who took out loans from Njangi to invest, are now facing ruin and threats.

“I am speechless. This is the end of the year, and I had things planned,” said Mary, a devastated subscriber. “I had money to withdraw, and now I can’t touch a franc. The platform is not even loading showing that these were all scammers.”

Reports from the user community paint a grim picture of panic and desperation across the country. “It’s a terrible tragedy,” said a platform member. “One woman is reported to have died from a heart attack because she couldn’t repay the FCFA 1 million she borrowed. People are fleeing their homes to escape those demanding refunds.”

The debacle serves as a stark warning, according to one observer. “My view is simple: Avoid all these quick money schemes,” they stated. “If you must invest, ensure that you don’t attach your heart there, because high blood pressure will be your portion.”

Attempts by The Post to contact officials of the MDB Marketing platform for comment were unsuccessful. Reports indicate that the website has been blocked, and none of their official contact methods are operational.