By Etienne Mainimo Mengnjo

Cameroon has launched a licensing round offering nine exploration and production blocks in two proven hydrocarbon basins, aiming to attract fresh investment as mature fields experience natural decline.

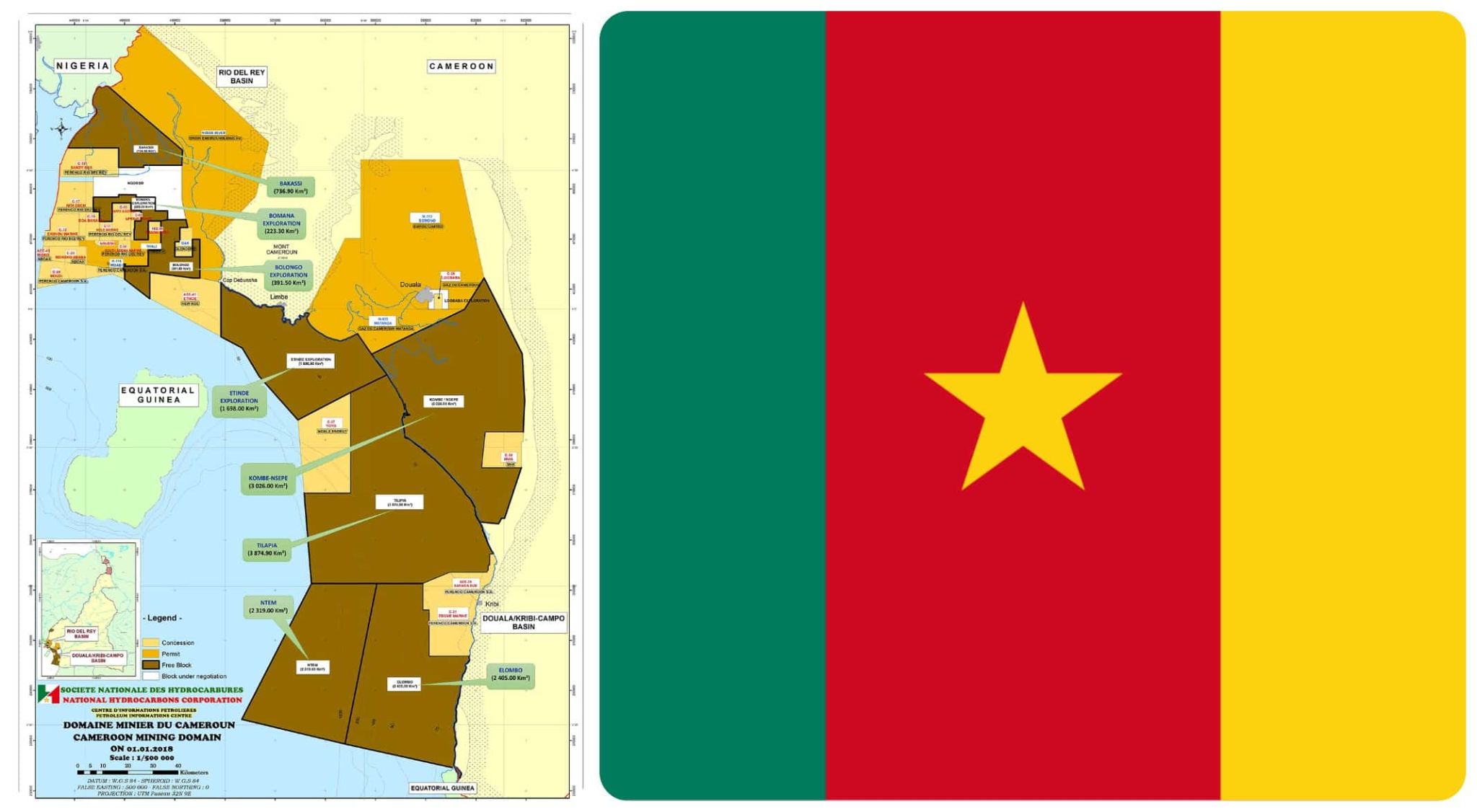

The tender, managed by the National Hydrocarbons Corporation (SNH), opened August 1, 2025, and remains open for proposals until March 30, 2026. Final awards are expected in late April. The round includes three blocks in the Rio del Rey basin: Ndian River, Bolongo Exploration and Bakassi. Six blocks are in the Douala/Kribi-Campo basin: Etinde Exploration, Bomono, Nkombe-Nsepe, Tilapia, Ntem and Elombo.

These blocks lie near existing producing fields, feature prior drilling, 2D and 3D seismic coverage, and identified leads and undrilled prospects. Such attributes provide investors with clear insights into exploration and development potential, reducing technical risks and entry barriers in these established provinces.

According to African Energy Chamber the licensing framework offers flexibility through multiple contractual options, including concession contracts, production sharing contracts and risk service contracts. Exploration periods vary by block. Bolongo Exploration, Bomono, Etinde Exploration, Tilapia, Ntem and Elombo carry an initial three-year term, renewable twice for two years each. Bakassi, Nkombe-Nsepe and Ndian River have five-year initial terms, also renewable.

Bidders must submit detailed proposals encompassing technical evaluations, minimum work programs, budgets, environmental and social commitments, and local content plans. Minimum work programs typically include drilling exploration wells, seismic acquisition and geoscience studies. Fiscal terms, such as profit-oil or profit-gas shares, royalties and cost recovery provisions, remain negotiable to ensure competitive conditions.

This approach underscores SNH’s efforts to rebuild investor confidence through greater transparency. The agency has published comprehensive data packages and bid criteria, while data rooms are accessible in Yaoundé and internationally.

“What makes Cameroon’s licensing round so compelling is the quality of the technical data available,” NJ Ayuk, executive chairman of the African Energy Chamber, said. “Investors can clearly see the reservoir potential, plan their drilling strategies and structure financing with confidence. Beyond the data, Cameroon has created a transparent and competitive framework, with clear contract terms and open negotiations, giving companies the certainty they need to move capital and execute projects effectively.”

The Rio del Rey and Douala/Kribi-Campo basins represent proven hydrocarbon provinces supported by existing infrastructure. Proximity to production facilities lowers costs and accelerates potential monetization. Comprehensive data enables companies to develop robust economic models and financing plans before the March deadline.

The round appeals to both independent operators and major international companies. Blocks with confirmed leads offer opportunities for material discoveries, while negotiable terms and incentives in exceptional circumstances provide advantages over more inflexible licensing regimes elsewhere.

“Both onshore and offshore, Cameroon possesses immense and largely untapped energy potential, underpinned by proven oil reserves and significant gas resources,” Ayuk continued. “These gas assets present a major opportunity not only to support domestic development and diversify the country’s energy mix, but also to position Cameroon as a competitive exporter to global markets. The current licensing round reflects this dual opportunity: unique onshore projects tailored to serve domestic demand are well suited to independents and African operators, while the LNG potential of large offshore gas discoveries should attract major international companies.”

The timing aligns with major African energy investment platforms. The Invest in African Energy Forum is scheduled for April 22-23 in Paris, convening investors, development finance institutions and technical partners to evaluate opportunities and form partnerships. The event has a history of leading to signed commitments and early-stage engagement.

Discussions from Paris can advance at African Energy Week, set for Oct. 12-16 in Cape Town. That gathering facilitates high-level interactions across the energy value chain to secure financing, partnerships and project execution.

With data consultations ongoing and the bid deadline approaching, the round stands as a timely opportunity in Central Africa. Leveraging the Paris and Cape Town events can help convert technical prospects into operational successes.

“Realizing the full value of Cameroon’s oil and gas resources will require strategic planning for both discovered and yet-to-find reserves, alongside a clear vision for their role in domestic and international energy markets,” Ayuk said. “We are confident this licensing round provides that pathway and strongly encourage investors to take a close look at Cameroon.”